Portfolio Manager Jarod Dawson writes that much fuss often gets made by market commentators about where a particular credit or equity index is marked at a given time, and then used to offer an often strongly worded opinion on whether that particular asset class is a good investment or not.

At PM Capital, we have built our business around the idea that at any given point in time there is always a company somewhere that has fallen out of favour with the market for reasons other than those pivotal to their business or industry. And as a result of falling out of favour, their credit or equity valuations have been negatively impacted - often unnecessarily.

Recently, there has been much discussion regarding the “nominal” level of credit spreads around the world and what this means for investment markets over the near to medium term.

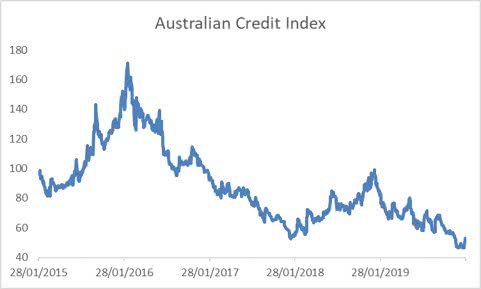

Below is an index showing the average credit spread of most liquid names in the Australian credit market (the 5 year Australian iTraxx index). As can be seen, on the surface one might make the case that credit spreads in general are starting to get pretty tight.

Source: Bloomberg – 5 Year Australian ITRAXX Index

We choose not to make a determination about the universe of available investment opportunities with reference to a particular arbitrary index. Rather, we just move on to the next idea – the search for the next “anomaly”.

Below are some examples of recent investments that we have made for the PM Capital Enhanced Yield Fund over the past 12 months. All of these are investments that have been issued by companies that we believe to be solid businesses, and at valuations that we think stand out – under pretty much any market conditions.

All of these investments have rallied considerably since we purchased them, contributing meaningfully to performance in varying degrees.

Now if we took the view (as big sections of the market often do) that just because of where some arbitrary index is being measured at a given time, that there must not be any real opportunities out there in which to invest capital, we would have missed out on the above opportunities and others like them. These opportunities have made important contributions to our Fund returns for both ourselves and our valued co-investors.

The point that I would really like to get across here is that, as an investor, if you just focus on looking for the real anomalies in credit markets, or equity markets for that matter, the rest will take care of itself. There are literally thousands of companies around the world that at one time or another might represent a significant investment opportunity – you just have to look in the right places at the right times.

We believe that investors should spend less time trying to work out whether a particular index is cheap or expensive and just focus their time on finding good businesses at a good price. That is our goal in managing the Enhanced Yield Fund, and to date we are more than pleased with the results.

More on the Enhanced Yield Fund

Subscribe for more insights to your inbox!

*Returns are calculated from exit price to exit price assuming the reinvestment of distributions for the period as stated and represent the combined income and capital return. Past performance is not a reliable indicator of future performance. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider a copy of the Product Disclosure Statement which available from us, and seek their own financial advice prior to investing.