Major bank subordinated bonds have been around for decades, and relative to their senior bond counterparts they have never been cheaper, writes Jarod Dawson.

As many of you will know, in order to raise funds that can then be on lent to consumers and businesses, banks issue senior unsecured bonds and hybrid securities - to everyone from fund managers like us, right through to Mum and Dad retail investors.

However, it may not be as well known to some of you that there is also a category of bonds issued by banks that sit in between these two categories – known as subordinated bonds.

Subordinated bonds contain some elements of both senior and hybrid bonds, but from a risk perspective they are closer in nature to senior bonds.

On behalf of our investors, PM Capital has been investing in subordinated bonds for almost two decades, and we have seen many different pricing environments for these bonds - but nothing quite like the current environment!

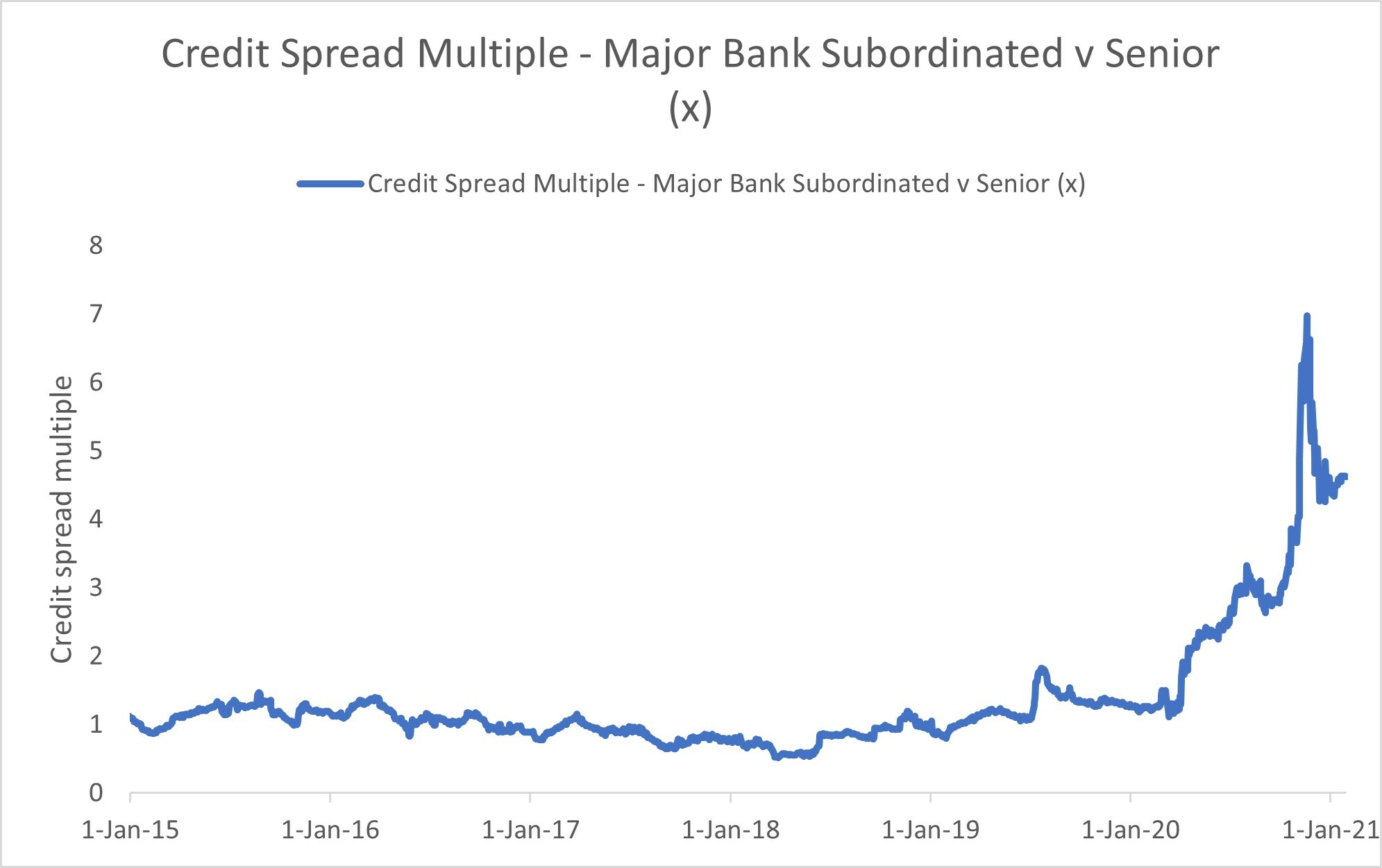

The risk premium (ie the additional yield above the cash rate received for investing in these bonds) paid on a subordinated bond is typically a multiple of that of a bank’s senior bonds. Historically this premium has averaged somewhere in the neighbourhood of one to two times senior bonds. However, over the past six months or so, there has been an extraordinary increase in this multiple.

Part of the reason for the increase is that it is expected that, under the new Basel III banking guidelines which have been widely adopted by banking regulators around the world, banks will have to materially increase the volume of subordinated bonds that they have on issue – and thus there will be a large increase in supply. The other main reason is that senior bonds have, to some extent over the past six months or so, become a proxy for cash as domestic interest rates approached zero.

While both of these drivers are important, we think that the multiple that subordinated bonds now trade at far exceeds the impact of these factors. Indeed, the recent subordinated bond issues that have come to market have been heavily oversubscribed by investors, suggesting to us that supply is being very well absorbed, and is likely to be far less of an issue going forward.

As can be seen in the chart, the magnitude of the recent move in the subordinated bond multiple is nothing short of extraordinary, peaking at a level of around seven times their senior bond counterparts, and currently sitting at around five times – well above the long term average of around one to two times.

Source: Westpac

At the peak of the hysteria we began building on our position in these securities, and thus the Fund has already benefitted from the early stages of normalisation of this relationship between senior and subordinated bonds.

This investment theme is a classic example of the sort of yield security anomaly that we look for at PM Capital, and the sort of investment that we wait patiently for when investing your and our hard earned capital.

Like many of the investments in the Enhanced Yield Fund, we think the investments related to our subordinated bond theme still have a considerable amount of upside to be realised.

More on the Enhanced Yield Fund