Five reasons to invest in unpopular stocks

Why out-of-favour companies can potentially be an investor’s best friend.

Investors are often attracted to star companies with rising share prices and commentators cheering them on. Swayed by market hype, these investors risk buying too late into a rally and overpaying for assets.

Another strategy is buying unpopular stocks the market ignores, overlooks or misunderstands. Quality, undervalued companies with strong underlying fundamentals can potentially make a big difference to portfolio returns over time.

PM Capital defines unpopular stocks as those in the bottom quartile of their historic valuation range. One such example is European bank stocks in our Global Companies Fund, which on average trade on 7 times earnings.

In our experience, unpopular stocks often suffer from simplistic top-down narratives that blind investors to value. European banks, it was claimed, would struggle in a sluggish European economy after COVID-19. Yet European banks have grown earnings consistently post COVID, aided by a normalisation of interest rates and a consolidating market. Dividends and buybacks have markedly increased resulting in double digit shareholder returns.

Many stocks, of course, are unpopular for good reason. The key is finding out-of-favour companies trading well below their true value because of irrational, short-term market sentiment – and that have good recovery prospects.

It takes conviction, courage and patience to own assets that seemingly everybody else is selling. But buying unpopular stocks, even though it can feel uncomfortable, is one of the keys to long-term wealth-creation.

At PM Capital, we believe in the power of different thinking. Here are five reasons why we invest in unpopular stocks.

1. Reduce risk

Valuation is the best form of portfolio risk management. Buying unpopular stocks when they trade in the bottom-quartile of their historical valuation range in theory means less downside risk.

Compare that to buying popular stocks trading in the top-quartile of their historic valuation range and ‘priced for perfection’. When the market turns, the slightest hint of bad news can crush valuations and trample investors late to the party.

2. Capitalise on volatility

Unpopular stocks can have even fewer friends during heightened volatility. When markets fall, some investors abandon their losing stocks because they refuse to sell their winners, creating even better value in unpopular stocks.

Capitalising on short-term market volatility in the context of a long-term investment framework is integral to PM Capital’s approach. We watch and wait for better value, often adding to positions in unpopular stocks during volatility.

3. Use sentiment to your advantage

Everybody loves a winner. It’s human nature to be excited about star companies and disappointed with underperformers.

In pursuit of popular stocks, some investors move from one new idea to the next, always searching for the next winner. Rarely do they revisit old ideas, even when valuations become attractive again.

Great investing requires a different mindset. At PM Capital, we ignore market noise and focus on what matters most: valuation. We are excited when valuations fall too far, and concerned when investors own an increasingly narrow group of overvalued popular stocks.

From experience, we know that unpopular stocks can potentially rise a long way when the market realises it’s wrong.

4. Benefit from index fund selling

Passive funds that replicate market-weighted sharemarket indices must buy more of a stock when its valuation rises, to maintain its index weighting. Conversely, they must sell falling stocks to reflect their lower index weighting.

This weight of passive money can drive rising stocks higher and push falling stocks lower, even though that makes no sense from a valuation perspective. The result: more attractive valuations can potentially emerge in unpopular stocks due to automated selling from passive index funds.

5. Pressure to perform

Over the years, several unpopular companies held in our funds have been taken over, delivering a premium to shareholders. Like us, other investors recognised latent value in a company and the market’s inability to recognise it. We never buy stocks on takeover merit alone, but owning unpopular stocks can potentially benefit investors through merger-and-acquisition activity.

At the other extreme, we’ve seen star companies become complacent and destroy value.

There are no guarantees, but high-quality, out-of-favour companies with good management teams have a habit of refocusing their strategy, improving implementation and working hard to restore market confidence.

Conclusion

It can take years for a company to go from unpopular to popular. Companies move much slower than markets. Refining, approving and implementing a strategy takes time. So, too, does attracting more customers and engineering performance turnarounds. Market forces that weigh on stocks, such as economic slowdowns or geopolitical risks, also take time to abate.

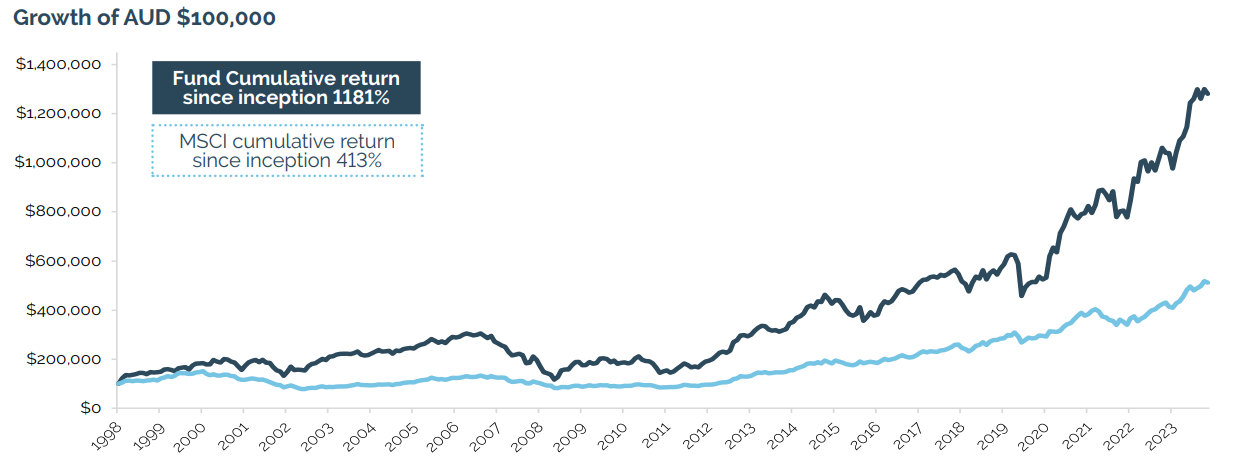

This is where investment patience creates a premium. And where asset managers, such as PM Capital, that are prepared to look through short-term sentiment, have achieved higher returns for clients, as the chart below shows.

Chart 1: PM Capital – Global Companies Fund (as at 31 August 2024)

An investment in the PM Capital Global Companies Fund carries risk, and like all investments, the Fund may make losses from time to time. Investors are advised to the consider the risk section of the Product Disclosure Statement.

Disclaimer

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity and issuer of the PM Capital Global Companies Fund (ARSN 092 434 618) ". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determination and the current Product Disclosure Statement (which are available from the PM Capital website), and obtain their own financial advice, prior to making an investment. Past performance is not a reliable indicator of future performance and the capital and income of any investment may go down as well as up.