Fox on the Run

By PM Capital

Key points

- PM Capital’s global strategies initiated a position in Fox Corporation in April 2024, believing the market’s negativity towards the wider cable-TV industry was clouding the latent value in the business.

- We thought viewer migration from Fox Corp cable-TV channels to streaming platforms would be slower than the market expected and offset by rising advertising revenues and affiliate fees due to the strength of its Fox News and Fox Sports channels.

- At the time of our initial investment, we argued that Fox traded at a cash Price to Earnings (PE) multiple of 5-6 times once non-core, non-income-producing assets, which the market overlooked, were adjusted for.

Introduction

Fox Corporation, a US-based multinational media company, produces and distributes content through brands such as Fox News, Fox Sports, Fox Entertainment, Fox Television Stations, and its new Tubi Media Group.

Led by Lachlan Murdoch as Executive Chair and CEO, Fox Corp derives more than three-quarters of its earnings from cable network programming. Fox News and Fox Sports lead their markets and dominate Fox Corp’s content bundle.

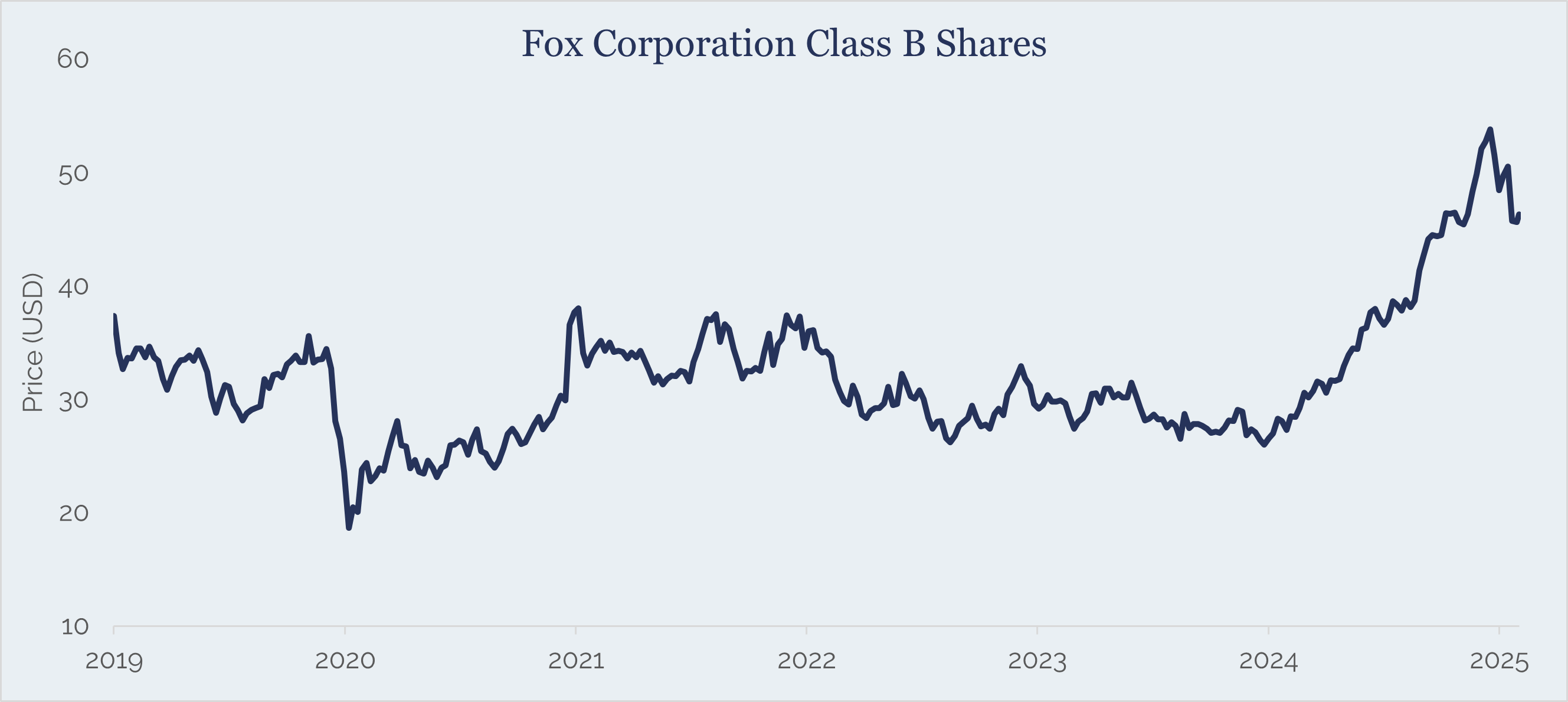

Fox Corp’s share price fell by almost a third over three years to March 2024 as investors feared the impact of cord-cutting in the cable-TV industry as consumers shifted towards streaming platforms such as Netflix, Disney+, Hulu, and YouTube.

As the market myopically focused on disruption to the cable-TV ecosystem from streaming, we identified a significant valuation anomaly—and investment opportunity—in Fox Corporation’s Class B voting stock. This led to a position being entered into in April 2024.

A year on from this initial investment, the company’s share price has nearly doubled as the market reappraises the strength of Fox Corp content and the broader value in its business, which only 12 months ago went unrecognized.

Chart 1: Fox Corporation Class B Shares

Source: FactSet, as at April 2025

Our Investment Thesis in Fox Corp Was Based on Four Main Factors:

1. Targeted Content

Unlike most cable-TV companies in the US, Fox does not offer a ‘long tail’ of entertainment channels. Entertainment content on cable-TV is increasingly being commoditized as streaming services such as Netflix, Disney+, Hulu, and YouTube increase the available content and, in many cases, replicate what is on cable-TV but at a cheaper price (e.g., Disney+ Hulu versus The Disney Channel). Cable distributors are trying to reduce the cost of the cable-TV bundle by cutting this long tail of entertainment channels, which has not affected Fox.

Fox Corp’s cable-TV portfolio consists chiefly of Fox Sports and Fox News—content that remains in high demand. Fox Sports is a ‘must-have’ for sports lovers, and Fox News has been the highest-rated US cable network for nine years.

While cable-TV viewers are migrating to streaming services, many still subscribe to Fox Sports to watch the National Football League, Major League Baseball, NASCAR, soccer, and a range of other local and international sports content for which it holds broadcast rights.

Even more powerful is the Fox News franchise, which commands a large and growing audience attracted to the channel’s conservative political slant and personality-driven news coverage.

PM Capital believed the decline in Fox Corp’s cable-TV subscribers would be offset by higher advertising revenues and affiliate fees per subscription (payments other cable and satellite providers make to Fox Corp to carry its channels).

2. Cyclical Tailwinds

We expected two factors to boost demand for Fox Corp content in 2024-25.

The first was the US Presidential election in November 2024 and the possibility of a Donald Trump victory. Presidential elections historically drive a wave of political advertising, which benefits both cable-TV channels and local broadcast television stations where Fox Corp also has a presence through the ownership of 29 stations and partnerships with 209 local affiliate stations.

As a conservative news outlet, Fox News was also best placed to attract viewers who would favour President Trump during a potential second term, driving increased ratings, attracting more advertisers, and increasing Fox Corp’s pricing power with affiliates who distribute its content.

This has transpired, with Fox News having its most-watched month in its network history in February 2025. Fox News had a 65% share of cable news viewers and delivered the top 838 cable news telecasts since US election day. Since Trump’s inauguration, Fox has led all broadcast networks in weekday primetime viewers. Fox News has also seen 100 new ‘blue-chip’ advertisers join its roster since the November election.

Sports programming was the second tailwind for Fox Corp. Fox Sports aired the NFL Super Bowl in 2025 (the main networks alternate hosting the event every few years).

As one of the world’s most televised events, the Super Bowl is one of the biggest advertising events of the year, with brands paying millions for a 30-second slot during the game. This year’s Super Bowl was also a first, with Fox broadcasting the game live on Tubi, its free streaming platform. This Super Bowl was the most watched of all time, with 127.7 million viewers across all platforms.

3. Strong Balance Sheet

Fox Corp had one of the strongest balance sheets in the media industry, far more robust than some of its closest peers, who had substantial leverage, which we believed could have a tangible impact on their ability to operate effectively.

Fox Corp had US$7.2 billion in outstanding borrowings and cash reserves of US$3.3 billion as of December 31, 2024. Total shareholder equity in Fox Corp was US$11.6 billion.

The company’s balance sheet has enabled it to repurchase US$6.1 billion of its shares since 2020, reducing the number of issued shares by 25% and capitalizing on the undervaluation we identified.

On the asset side, Fox has several investments that PM Capital believed the market had undervalued, including its 2.5% stake in Flutter Corporation, a leading global online sports-betting agency benefiting from strong growth in legalized US sports betting. At its market value today, this stake is worth over US$1 billion; however, given Flutter is accounted for as an equity investment it has no profit and loss P&L contribution as the company does not pay a dividend.

Fox also holds an option expiring in 2030 to acquire 18.6% of FanDuel, the leading daily sports-fantasy platform in the US that Flutter owns. FanDuel’s growth potential was a key factor in PM Capital’s previous holding of Flutter.

At its second-quarter earnings announcement, Fox argued that its stake in Flutter and the option to acquire part of FanDuel were worth a combined US$3.9 billion.

Other underappreciated Fox Corp assets include its studio lot in Los Angeles, its Deferred Tax Asset attained through the sale of Twenty-First Century Fox to Disney in 2019, and its Tubi free streaming platform.

4. Valuation

When PM initiated a position in Fox Corporation last year, the stock traded on a cash PE multiple of 5-6 times, based on our assessment of the company’s Enterprise Value and future earnings.

That was a remarkably low multiple given Fox Corp’s content portfolio, market position, and leverage to sports and news/politics content—two growth markets. At the time, Fox’s PE multiple was substantially lower than its main rivals.

With shares almost doubling in the past 12 months, Fox Corp no longer trades at a bottom-quartile valuation relative to its historical valuation.

PM Capital’s investment style is to buy companies when they trade at bottom-quartile valuations and sell when they achieve top-quartile valuations—something that may be closer for Fox Corp given the magnitude of its share-price rally.

Conclusion

PM Capital’s position in Fox Corp reinforces the benefits of challenging consensus thinking and the often simplistic narratives that evolve from it, in this case, the migration of viewers towards streaming platforms and the ‘death of cable.’

We are always searching for areas of disruption that have the potential to create significant valuation anomalies for PM Capital to exploit. The disruption in the media industry was one such area.

Notes

All analysis and commentary at 3 March 2025.

Cash price to earnings adjusts for the impact of Fox Corporation’s deferred tax asset which reduces the cash tax payable compared to the reported tax represented in the profit and loss. Non core, non-income-producing assets include Fox Studio Lot in Los Angeles (a non-core asset) as well as investments such as Flutter and Fox Corporation’s option to acquire an 18.6% stake in FanDuel (non-income-producing assets). These assets/ investments have been subtracted off the company’s Enterprise Value based on market valuations or PM Capital’s appraised valuations.

Disclaimer

This insight has been prepared by PM Capital Limited (ABN 69 083 644 731, AFSL No. 230222) as responsible entity and issuer of the PM Capital Global Companies Fund (ARSN 092 434 618). It is general information only and is not intended to provide you with financial advice, and has been prepared without taking into account your objectives, financial situation or need. You should consider the product disclosure statement (PDS) and the Target Market Determination which are available from us for free at www.pmcapital.com.au/steps-investing.

If you require financial advice that takes into account your personal objectives, financial situation or needs, you should consult your licensed or authorised financial adviser. This information is only as current as the date indicated, and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Certain statements in this presentation may constitute forward looking statements. Such forward looking statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the PM Capital and which may cause actual results, performance or achievements to differ materially (and adversely) from those expressed or implied by such statements.

Past performance is not a reliable indicator of future performance. All investments contain risk and may lose value, please refer to the PDS for more information.

The information contained in this insight is for fund investor use only. The views expressed herein are part of a wider fund investment strategy and should not be considered in isolation.