By Jarod Dawson, Global Yield Portfolio Manager

Many decades ago, National Australia Bank issued the NAB Income Securities (ASX code: NABHA) - a floating rate hybrid security paying a quarterly interest coupon, which at the time was fairly ground- breaking. It was a way of issuing equity capital but without the costs of doing a more traditional issue of common shares.

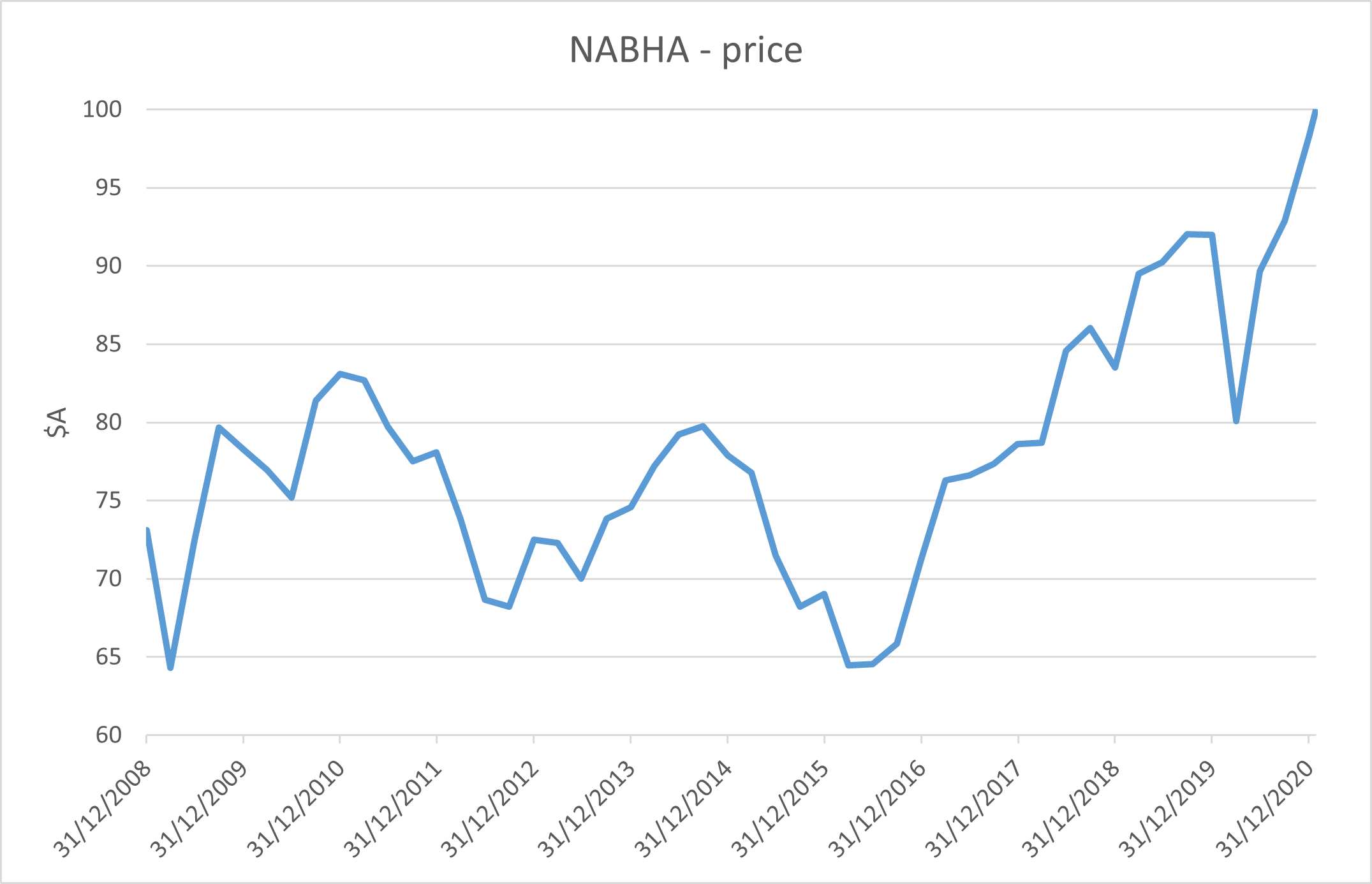

Things were all going along swimmingly, until the Global Financial Crisis hit in 2008/ 09. Due to the long-dated nature of the securities, and the change in what the market deemed an acceptable rate of return on hybrid securities during and post this period, the capital value of the securities fell below their $100 issue value – well below - as can be seen in the diagram below!

Source: Bloomberg

To further complicate matters for these securities, in 2009 global banking regulators came together and formed what was to be known as the Basel III accord. It was a set of reforms designed to mitigate risk within the international banking sector. Among other things, it also reset the standards for determining how much capital a bank should hold and what that capital should look like.

One of the determinations under the accord was that hybrid capital would need to be readily convertible into common shares, and also potentially be loss absorbing in the event that the bank’s fortunes deteriorated significantly. Hybrid securities that did not meet these criteria would slowly begin to lose their ability to be considered equity capital on bank balance sheets.

Under the guidelines, it looked to us as though the NABHA would not meet these criteria and thus over time would contribute less and less to NAB’s equity capital position. It appeared that by the end of 2021 the NABHA would not contribute much to their equity capital, if at all.

With this view in mind, in the years post the introduction of the Basel III accord we took advantage of the heavily discounted pricing of the NABHA, as markets continued to grapple with the long-dated nature of the security and the uncertainty as to if and when NAB might decide to replace them with a yield security that more closely reflected the Basel III criteria.

We held a strong view from very early on that as the December 2021 deadline approached, NAB would ultimately redeem these bonds at their $100 par value. In the meantime, we were happy to go on receiving the coupon that they were paying.

Sure enough, on 6 October 2020 NAB announced that it intended to put a vote to its shareholders to redeem the NABHA as a result of the implications of the Basel III accord and the impact on NAB’s capital structure. Subsequently, on 18 December, at NAB’s Annual General Meeting, the redemption of the NABHA at $100 per security was approved by shareholders, and on 11 January 2021 NAB formally announced that the securities will be repaid on 15 February 2021.

Over the years, we accumulated our position in the NABHA at a capital price of ~$80, which along with the quarterly floating rate coupons that the bond has been paying has resulted in a return of around 40% for PM Capital and our valued clients. Not a bad return for a yield security!

This sort of patient long term investing is emblematic of the sort of contrarian investing that we do across all the funds at PM Capital.

As evidence of this, not only have we held a significant investment in the NABHA in the PM Capital Enhanced Yield Fund, but we also have a meaningful investment across our Global and Australian equity portfolios. This not only highlights just how significant we felt the opportunity was, but also how at PM Capital we have structured our investment mandates to ensure that we can take advantage of as many investment anomalies as possible - in all our portfolios.

More on the Enhanced Yield Fund