Annabelle Miller, Investment Analyst, explains our approach to this global leader.

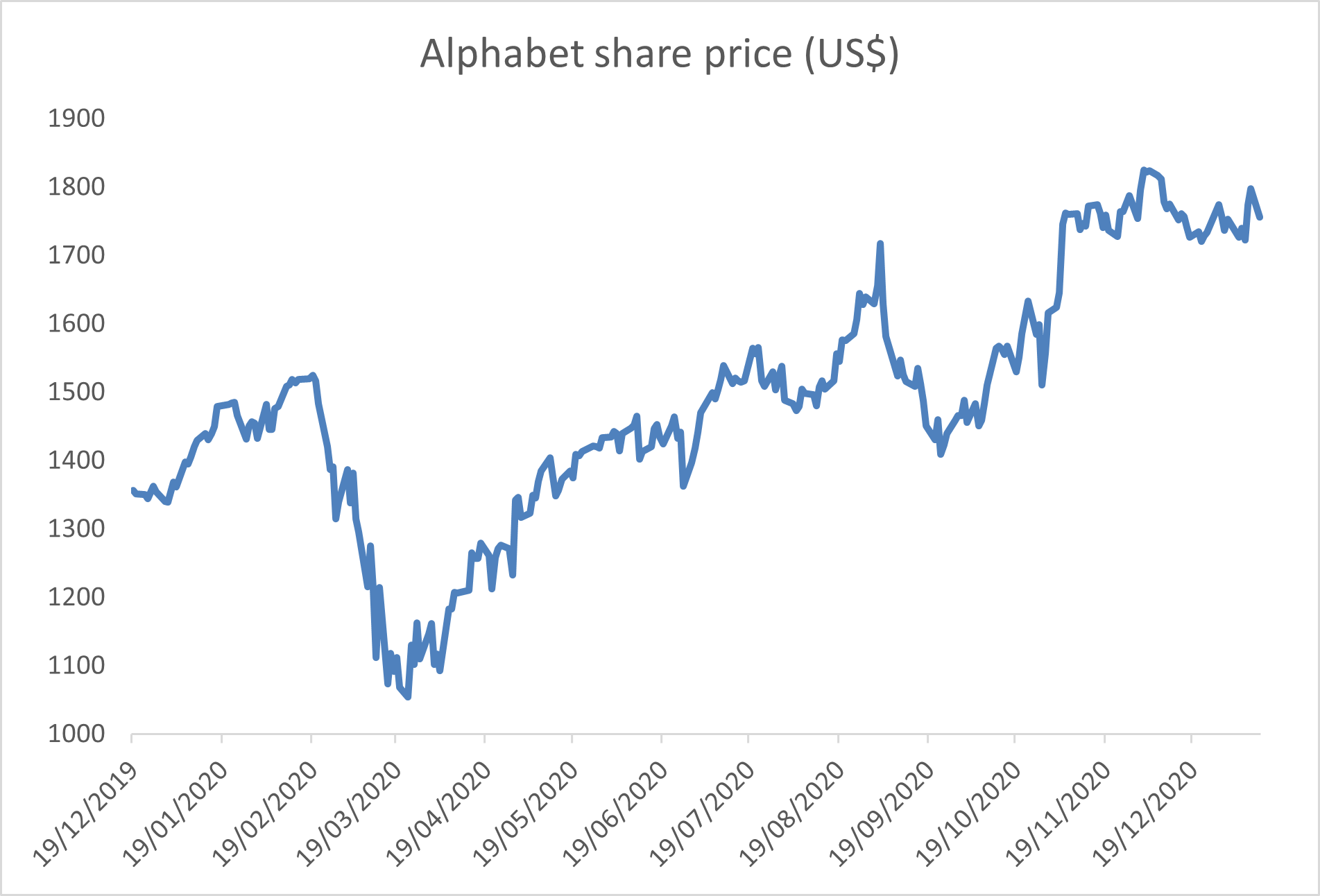

In May 2020, PM Capital published a piece entitled, Google – Resilience and growth out of recessions. This article addressed the reinstatement of Alphabet as a holding in the Global Companies Fund and the Global Opportunities Fund (ASX: PGF), taking advantage of the lows made following the COVID-19 draw-down in March 2020. We have now exited the stock again and it is interesting to follow our thought processes in relation to our activity in the stock.

Our re-entry in March stemmed from our belief that the core Google business could emerge stronger from the COVID crisis. At that point in time we were acquiring the core business on a high-teens price to earnings multiple/ mid-single digit ungeared yield. To our mind this was a conservative estimation of value as the core Google business includes YouTube and Cloud (GCP). The company was significantly reinvesting in these businesses, masking the underlying profitability of the highly profitable Google Search franchise.

Source: Bloomberg

Fast-forward to the end of 2020 and Alphabet has undergone a significant upward re-rating. The first catalyst for the re-rating the business experienced through 2020 was a function of better than expected revenue growth in the search business which lagged in the early stages of the recovery. While there remains some catch-up as the travel and leisure advertising normalises, it seems to have largely been factored in by market estimates in 2021 and 2022.

The second catalyst emerged in the third-quarter results, in which management highlighted its intention to provide greater visibility into key segments including operating income for GCP and YouTube. After witnessing the re-rating Amazon experienced after breaking out Amazon Web Services in 2015, it became a clear factor in unlocking further value in our Alphabet holding.

Google Cloud has been the laggard behind Amazon and Microsoft having under-delivered on its go-to-market strategy under former CEO, Diane Greene. Since hiring Thomas Kurian from Oracle, GCP has turned a corner investing heavily in turning around its go-to-market strategy, simplifying pricing plans, hiring technical specialists and expanding partnerships. The willingness of management to break out Cloud was interpreted by the market as a signal of confidence behind the changes made under Kurian.

Our exit prior to the break-out of underlying profitability of Cloud and YouTube might be viewed as ‘buy the rumour, sell the news’. The valuation of the core business has re-rated to the highest forward price to earnings multiple in 10 years at close to 30x consensus 2021 earnings on the back of a cyclical recovery in search and greater visibility into underlying growth drivers. We await a better re-entry point as we have executed at previous points in time, when the market has allowed us to re-purchase the business at a more reasonable valuation.

The content reflects opinions as at the time of writing and may change. PM Capital may now or in the future deal in any security mentioned. It is not investment advice.

Want to be the first to learn about our insights and events? Subscribe below!

More on the Global Companies Fund

More on the ASX-traded Global Opportunities Fund