Quebrada Blanca II – Visiting a high-altitude Andean copper mine

Teck Resources’ new copper mine is on the cusp of full production

By Alex Warnaar, PM Capital

In November 2023, Teck Resources invited a handful of investors to visit Quebrada Blanca II (QBII) and meet the management and operational teams. QBII is Teck’s new flagship asset, a high-altitude copper mine located in northeastern Chile near the Bolivian border. The trip was Teck’s first investor site-visit in South America for over a decade, and PM Capital was the only Australian investment firm in attendance.

QBII has nameplate production capacity of approximately 300,000 tonnes of copper annually, placing it in the top twenty largest copper mines and Teck close to one of the top ten largest copper producers globally. The mine carries significance beyond the incremental copper production, it is Teck’s first new base metals development in many years and begins their copper growth phase.

The mine ramp-up comes after a turbulent year for Teck. In April 2023, Teck proposed to separate the metallurgical coal and base metals businesses but maintain a complex link via an earnings royalty, which PM Capital publicly rallied against and shareholders ultimately rejected1. By November 2023, management changed tack and announced the sale of the metallurgical coal business to Glencore and Nippon Steel, this time a simple separation but at an underwhelming price. After all fees and taxes the cash consideration will total just shy of US 8 billion dollars, a low price for a business that, at current benchmark metallurgical coal prices exceeding US 300 dollars per tonne, generates several billion dollars of income per year. Meanwhile, delays and scope changes mean QBII’s final development cost will total around US 8.5 to 9.0 billion dollars, well beyond the original budget of just over US 5.0 billion. For such a high price tag we decided to see it for ourselves.

Photo A: QBII tailings dam as seen from the air

Upon arrival, our first observation was the relatively low presence of Teck employees on site. Most of the mine runs automatically and it felt sparse. The trucks are autonomous, and the main mine command centre is several hundred miles south in Santiago, with two secondary centres – one in the nearby coastal town and the other at the mine itself.

At 4,000-4,500 metres above sea level, some newly recruited construction workers struggled with the lack of oxygen and lasted only a day on the job, and some unacclimatised members of the site visit required brief oxygen assistance towards the end of the day.

Photo B: QBII mine

One of QBII’s primary competitive advantages is its low stripping ratio, 0.7 over the mine’s lifespan. Teck only needs to remove 0.7 tonnes of overburden (waste rock) for every tonne of processable ore body, whereas at other world class Chilean copper mines such as BHP’s Escondida or Glencore’s Collahuasi, the ratio can be 3.0 or 4.0. On the other hand, the average grade is a disadvantage: less than half of one percent of each tonne of ore body extracted is copper, whereas grades at other mines can exceed one percent. The low stripping ratio but low grade means QBII is not an earth-moving exercise per se but rather a processing exercise. Most of what is visible in Photo B is ore body, Teck digs into the side of the hill.

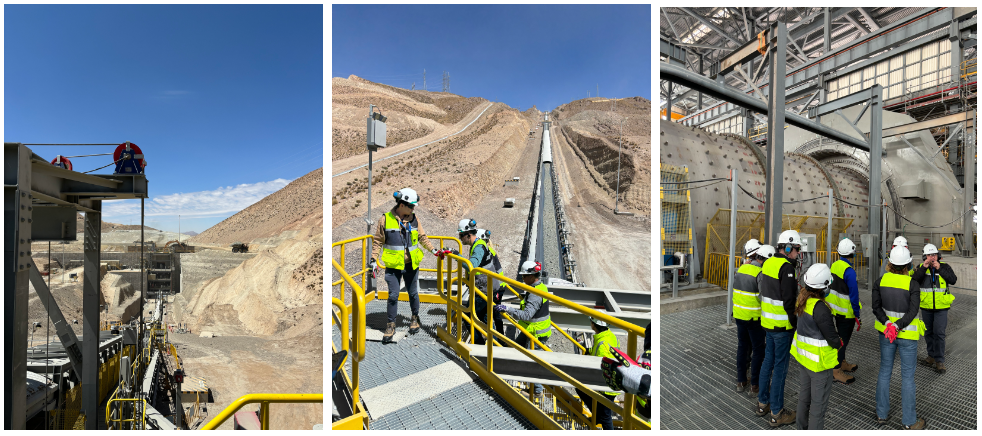

Photo C: Primary crusher

Photo D: Conveyor belt from the crusher to the ore stockpile. I estimate it moves dirt at 30-40 kilometres per hour.

Photo E: A grinding machine within the mill, it was operational at the time of the photo

QBII was constructed with extra capacity and the future in mind. The primary crusher, which reduces ore from boulder to golf-ball sized pieces (Photo C), is capable of 25-35 percent more than mine nameplate capacity and feeds the conveyor system, which also has extra capacity (Photo D). The pipelines to and from the coast would only require extra pump installations (the foundations of which have already been built) to move more water. Careful consideration has been given to the finer details as well. The desalination plant sources deep and unperturbed water far off the coast to reduce wear and tear on the plant. Teck have also invested in water recycling at the mine, despite having excess desalination and pipeline capacity.

The mine’s bottleneck is the grinding mill (Photo E). With secondary and tertiary crushers, the mill reduces the golf-ball sized ore pieces to a fine sand. For the approximately first five years, the ore is soft and thus easy to grind. Teck’s operational team, both the operational command in Santiago and on site, state they’ve already seen promising periods with the mill operating beyond nameplate capacity; the nameplate is for hard rock, but with soft rock they hope to do better. Overall, Teck are genuinely excited about the early-stage operational performance.

Where to from here

In August 2022 we wrote about the new era at Teck Resources, how Teck has an excellent mix of assets and growth options abound at a time of structural supply shortages. We also discussed a more balanced capital allocation framework, emphasising carefully structured growth to avoid stretching the balance sheet and to avoid consigning Teck’s stock price to, in former CEO Don Lindsay’s words, the “penalty box”.

The new era we envisaged is arriving but unfortunately under the veil of a messy year. Strong earnings out of the metallurgical coal business have largely gone towards funding cost increases at the QBII development rather than being distributed to shareholders. The disastrous proposed transaction to separate the coal and base metals businesses distracted investors and harmed management credibility, and the eventual sale price did little to recoup that lost credibility. Teck’s stock price is still firmly stuck in the penalty box, and we believe Teck still has top-quartile assets at a bottom-quartile valuation.

The remedy is straightforward and depends on QBII, now almost fully ramped-up, achieving its nameplate capacity and its expected operating cost structure. It also depends on appropriate capital allocation of the roughly US 8.0 billion dollar net proceeds from the metallurgical coal assets sale, as well as the strong coal earnings between now and the sale completion date. A substantial share buyback program beckons.

Teck stock has plateaued for some time at around US 40 dollars per share. We believe the stock is close to an inflection point and recently bought more shares.

About the author

Alex Warnaar is an investment analyst at PM Capital, a leading Australian asset manager in global and Australian equities, and interest rate securities. More PM Capital Insights are available here.

Notes

1See The Globe and Mail article, Teck CEO plays down quick sale of Teck Metals to largest competitor, saying most value to come from in-house copper projects, 13 April 2023

This Insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618), the "Fund". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund's Net Asset Value are calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.