Amazon is a classic example of a technology gorilla. Investment Analyst Annabelle Miller reports.

As Geoffrey Moore et al (*1) put it, gorillas do not just use their own company’s features and benefits to compete, but harness the supply chain itself as a weapon.

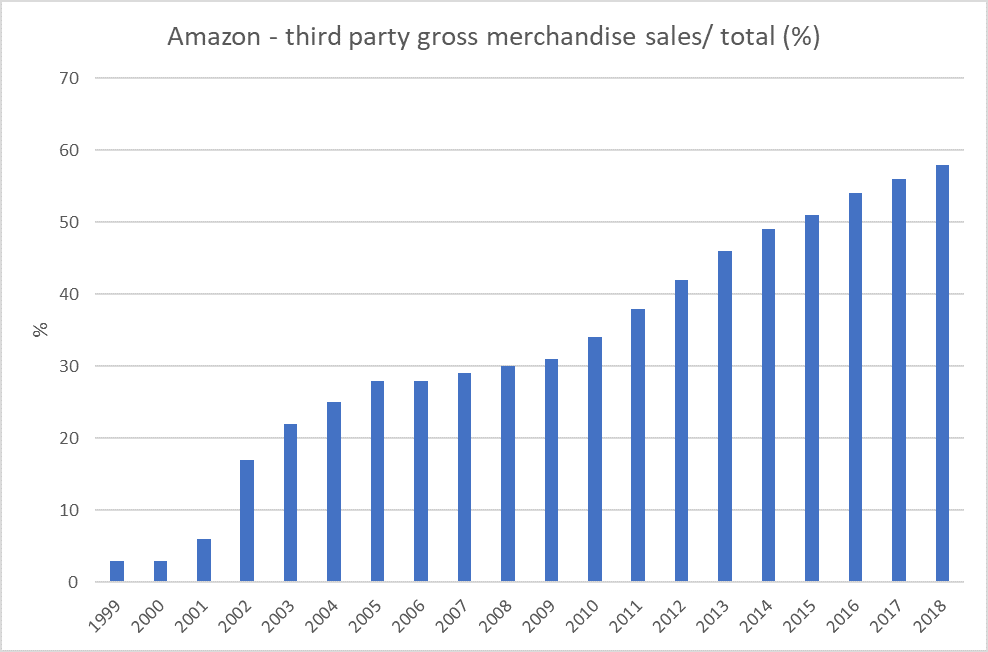

We have seen over the last 20 years how Amazon’s position as a gorilla has evolved within the e-commerce value chain. At its outset, Amazon built its marketplace to service its own business – products that it directly sold.

Source: Letter to Shareholders, Amazon, April 2019.

Over time Amazon realised small and medium sized enterprises lacked the online and delivery infrastructure required to fulfil customer demand and could benefit from its infrastructure. This ‘marketplace’ service for third-party sellers has proven to be highly successful - independent third-party sellers have grown to represent more than half of Amazon’s gross merchandise sales. As Jeff Bezos has put it, third-party sellers “are kicking [Amazon’s] first-party butt. Badly.” These small and medium-sized businesses now number nearly 2 million in total.

However, Amazon has turned the higher relative attractiveness of third-party offerings to its own advantage. The rise of the third-party marketplace has enabled it to develop higher margin offerings than it can get on its first-party products alone. As the ‘shop-front’ for digital native brands, they pay Amazon fees for digital marketing services. Amazon has developed the third largest digital advertising platform outside of Google and Facebook, In 2018, the e-commerce giant generated $10.1 billion in ad revenue, up 117% YoY from $4.7 billion.

Amazon's ad business will grow overall through its ability to target millions of consumers with purchase data from its place as the supply chain gorilla, and will leverage that across its array of platforms - Amazon.com, mobile app, MDb TV, and devices (Fire TV, Echo), Twitch. By 2023, Amazon could take as much as 14% of total US digital ad sales, up from 9% in 2019 (*2), per Business Insider Intelligence estimates, based on eMarketer data.

There are claims that Amazon is using its position as the overseer of the most popular marketplace to develop its own branded products, copying and crowding out the small to medium-sized businesses who pay it fees. Amazon rejects the claim.

This evolution from building something for itself and then expanding it to cater for others is not unique to the e-commerce value chain. It has also emerged in the cloud computing value chain. Amazon was an early mover in building server infrastructure to support the growth of its e-commerce platform. Naturally, the platform experienced peaks and troughs in required capacity and it moved to rent out excess capacity to businesses who lacked sufficient computing capacity.

Now, through Amazon Web Services, it provides a combination of infrastructure as a service (IaaS), platform as a service (PaaS) and packaged software as a service (SaaS) offerings. Amazon’s cloud business produced $9.95 billion in revenue in 4Q 2019, up 34% on the previous corresponding quarter. It made two thirds of Amazon’s overall operating income in the quarter (*3). Although it is a stand-alone business dealing with third parties, the information gained on how effective its services are, tried out and proven with the customers who pay them, can be used across the Amazon network.

We are now on the verge of Amazon using another platform built for itself become a platform for others. A few years ago Amazon launched Amazon Go, a checkout-free way to visit an Amazon store, shop, and purchase without having to wait in line.

The launch of Just Walk Out by Amazon allows retailers to leverage the technology behind Amazon Go to adopt register-free checkout. This would enable retailers to free up in-store associates to provide higher levels of customer service and consumers with a frictionless, faster way to shop. Recall, however, that a gorilla like Amazon often uses the chain itself as a weapon.

While Amazon would protect customer data - information collected about consumers will only be used to support the retailers it has partnered with - it could use feedback collected from sensors and algorithms to improve its own in-store offerings.

Retailers still have memories of businesses like Borders and Toys’R’Us negotiating deals with Amazon to run their ecommerce operations through the Amazon platform only to find Amazon emerge as a competitor. Subsequently both businesses are no longer around. The question remains whether Amazon is a friend or foe?

*1 The Gorilla Game: Picking Winners in High Technology. Geoffrey Moore, Paul Johnson, and Tom Kippola (1998)

*2 Business Insider Intelligence estimates, based on eMarketer data.

*3 https://www.cnbc.com/2020/01/30/aws-earnings-q4-2019.html

Want to be the first to learn about our insights and events? Subscribe below!

More on the Global Companies Fund

More on the ASX-traded Global Opportunities Fund

The content reflects opinions as at the time of writing and may change. PM Capital may now or in the future deal in any security mentioned. It is not investment advice.