Unloved lithium powers valuation opportunity

China study tour confirms supply constraints and potential for higher lithium price.

By Andrew Russell, PM Capital

Key points

- Listed lithium mining and refinery companies are out of favour with investors, amid sharp falls in the lithium price since late 2022.

- With speculators deserting the lithium sector, opportunities are emerging in undervalued lithium companies for patient investors who can look through short-term noise and potentially capitalise on market volatility.

- Lithium has hallmarks of other successful PM Capital commodity positions in copper, coal and oil. Recent price falls have curtailed lithium supply, possibly setting the lithium price up for its next growth phase. We view the current depressed price as unsustainably low.

- PM Capital has initiated a position in Mineral Resources. We believe the diversified mining services, iron ore and lithium producer provides lower-risk leverage to a potential lithium-price recovery this decade.

1. Introduction

In early June 2024, PM Capital visited China’s four largest listed lithium producers.[1] Our goal was to understand the latest developments in China’s lithium supply and the marginal cost of producing lithium chemicals there.

Company visits are an important part of PM Capital’s research process. With commodities, visits across a supply chain – from upstream minerals explorers and producers to downstream processors and retailers – help us identify the marginal cost of production. This cost ultimately supports mineral pricing in the long term – and thus company earnings and valuations.

Over three days, we met with lithium companies across China, piecing together the cost structure of lithium production from the mine all the way through the processing and refining chain. Despite Chinese lepidolite miners being pegged as the marginal cost producer globally, actual production cost estimates vary wildly.

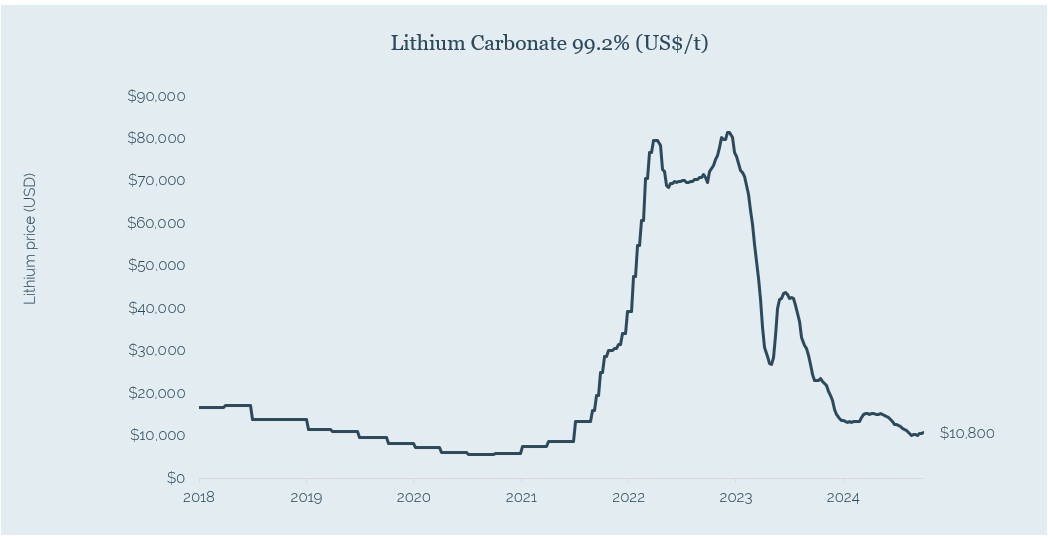

The volatility in lithium markets has been astounding. Since late 2022, the lithium price has slumped 85%[2], and now sits some 25-30% below the average Chinese cost of production. As expected, some Chinese operators have started cutting back supply in response to the falling lithium price.[3]

So, too, are non-Chinese lithium producers and processors. In August 2024, Albemarle, the US lithium giant, announced it would scale back operations at its lithium processing plant in Australia and halt the facility’s expansion. Also in August, Arcadium Lithium (now the subject of a takeover by Rio Tinto) announced it would defer investment in two of its four current expansion products in Canada and Argentina.

The lithium sector is rapidly adjusting to lithium price volatility by curtailing supply. When lithium prices soared in 2021 and 2022, too much new supply in lithium production and refining came to market. This excess supply overwhelmed weaker-than-expected demand for Electric Vehicle (EV) batteries, causing the lithium price to plunge from its high. Chart 1 below shows these boom-and-bust conditions in the lithium price.

Chart 1: Lithium Carbonate spot price (CNY per metric tonne)

Source: Trading Economics, as at 30 September 2024

2. Capitalising on short-term volatility

PM Capital’s investment process is designed to take advantage of short-term market volatility in the context of a long-term investment framework. We seek to identify and exploit valuation anomalies when sentiment is extreme.

In our experience, the most attractive valuation opportunities tend to emerge in deeply out-of-favour sectors and unpopular stocks.

That is true of lithium. When the lithium price soared, speculators piled into the market. They were attracted by the soaring lithium spot price, even though only a fraction of production sells at the current price. PM Capital avoided the lithium boom, believing valuations were driven by speculation rather than fundamentals.

For a time, lithium stocks were the talk of the Australian equities market and financial media. Today, many investors have seemingly given up on lithium, even though the metal’s positive long-term fundamentals are firmly intact.

3. Using a similar playbook with lithium

We see parallels between lithium and other PM Capital commodity investments, particularly copper, one of our most successful positions in the past five years.

In 2019, PM Capital initiated positions in leading copper producers, believing a higher copper price was required to incentivise a supply increase. We correctly thought copper supply would lag demand this decade as copper producers curtailed supply – and as demand for copper used in Electric Vehicles (EVs) rose.[4]

We visited copper producers and spent time understanding the marginal cost of copper production. We have taken a similar approach with lithium, identifying growing supply constraints amid rising long-term lithium demand from EVs.

In the medium term, cutbacks in lithium supply could support a price recovery. Like other commodities, lithium is becoming harder to produce. Approvals for new mines, or extensions to existing ones, take longer and mines cost more to develop. Lithium supply cannot increase quickly, meaning a supply shortfall this decade might set the lithium market up for its next leg of price growth.

We do not expect a similar price rally to that in 2021 and 2022. A higher lithium price, however, will be required to incentivise firms to increase production and processing. That incentivisation price is not as high as it was two years ago, but in our view, is significantly higher than where lithium trades today.

Longer term, global demand for lithium from EVs should rise. The market got ahead of itself with expected EV demand – a key reason why the lithium price soared. In 2021, US President Joe Biden set an ambitious new target to make half of all new passenger vehicles sold in the US by 2030 emission-free.

Although bullish EV forecasts have disappointed, we still expect approximately 20% annual growth in global EV demand this decade to drive greater demand for lithium chemicals and providing ongoing support for commodity prices.

4. Mineral Resources

Another advantage of analysing supply chains is identifying where best to invest. The middle part of the supply chain – lithium refineries – remains vastly oversupplied and dominated by China.[5]

Our preference is to invest in high-quality, low-cost upstream lithium producers that mine the hard rock rather than lithium chemical processors. It’s where we expect lithium supply challenges to be most intense.

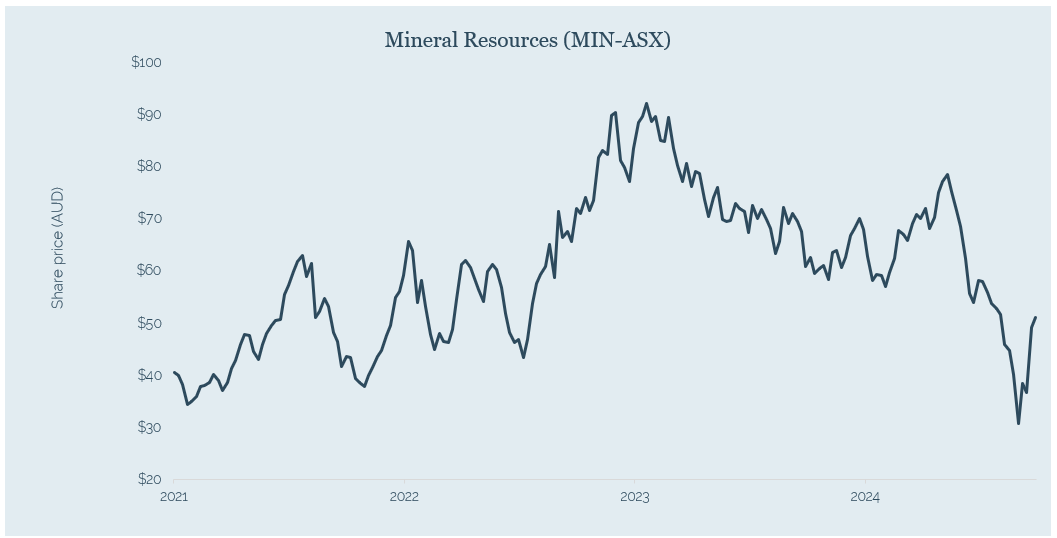

Mineral Resource fits this approach. PM Capital has followed Mineral Resources for some time. In 2023, we took a position in the company’s US bond offering, providing an attractive yield of 9.25% for the PM Capital Australian Companies Fund. We have also initiated a position in Mineral Resources equities after a period of significant share price weakness.

Chart 2: Mineral Resources (ASX: MIN)

Source: Google Finance, as at 30 September 2024

We believe Mineral Resources is positioned to benefit from any improvement in the lithium price, with investments in three world-class hard-rock lithium mines: 50% ownership of the Wodgina and Mt Marion mines, and 100% ownership of the Bald Hill mine in WA. The company is also benefitting from the current ramp-up of its low-cost iron ore project in Western Australia.

Mineral Resources has three main divisions. At current commodity prices, Mining Services is by far the largest contributor to earnings, followed by Iron Ore and Lithium.[6] The segment generates income on a per tonne basis, meaning swings in the underlying commodity price do not affect earnings.

This smoother earnings profile should attract a valuation premium, however Mineral Resources trades at a significant discount to the global majors in part due to a perceived stretched balance sheet which doesn’t account for likely asset sell-downs and a turnaround in free cash flow generation.

As such, Mineral Resources is not a pure play on a potential lithium-price recovery. At this stage in the lithium cycle, we prefer Mineral Resources’ diversified operations. Based on current implied valuations, the market is ascribing little value to future earnings from its lithium operations, providing investors with a ‘free option’ on an improving lithium market. In addition, we are attracted to Mineral Resources’ business model and management’s ability to execute favourable deals.

We continue to analyse other lithium stocks but are waiting for lithium supply/demand fundamentals to improve before adding pure-play operators to the portfolio.

Conclusion

PM Capital’s investment in Mineral Resources highlights our investment approach to identify and exploit valuation anomalies during market volatility.

Our view on lithium reinforces the benefits of meeting with local and global companies to develop industry insights and understand supply chains. These insights can potentially provide an edge when investing in out-of-favour sectors.

Most of all, our investment in Mineral Resources highlights the importance of patience, discipline and a long-term view. We do not expect a quick recovery in lithium, nor do we rule out the potential for further short-term price volatility.

This is where an intense focus on valuation is crucial. By investing in a company whose lithium assets currently have basically zero implied market value, we are aiming to manage any downside risk, while providing strong leverage to any upside from a potential lithium price recovery this decade.

About the author

Andrew Russell is a senior analyst and portfolio manager at PM Capital, a leading asset manager in Australian and global equities, and interest rate securities. More PM Capital Insights are available here.

Disclaimer

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618), the PM Capital Australian Companies Fund (ARSN 092 434 467) and the PM Capital Enhanced Yield Fund (ARSN 099 581 558), the "Funds". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor. All investors should seek their own financial advice, and must not act on the basis of any matter contained in this communication in making an investment decision bust must make their own assessment of the Funds and conduct their own investigation and analysis prior to making a decision to invest. Investors should consider the Funds’ Product Disclosure Statement and the Target Market Determination which are available on the PM Capital website at www.pmcapital.com.au/steps-investing.

Past performance is not indicative of future performance. The objective is expressed after the deduction of fees and before taxation. The objective is not intended to be a forecast, and is only an indication of what the investment strategy aims to achieve over the medium to long term. While we aim to achieve the objective, the objective and returns may not be achieved and are not guaranteed. Certain statements in this Insight may constitute forward looking statements. Such forward looking statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the PM Capital and which may cause actual results, performance or achievements to differ materially (and adversely) from those expressed or implied by such statements.

[1] PM Capital visited lithium companies in China as part of a small broker-organised study tour including Ganfeng Lithium, Tianqi Lithium, Yahua Industrial Group, Yongxing Special Materials.

[2] From peak to trough, late 2022 to 12 August 2024. Based on spot price for Lithium Carbonate in CNY per tonne.

[3] Reuters

[4] Reuters and ‘EV Markets Reports’

[5] BloombergNEF

[6] Based on 1H24 results. Ranked by 1H24 revenue.