By Annabelle Miller, Investment Analyst.

“All happy companies are different: Each one earns a monopoly by solving a unique problem. All failed companies are the same: they failed to escape competition.” – Peter Thiel

In 2014 , Peter Thiel, the founder of PayPal and Palantir, gave a lecture at Stanford University called “Competition is for Losers”. Thiel argued there was only two categories of businesses – non-monopolies and monopolies. The aim of any business should be to become a monopoly in their area of business, to create a distinct image and use it to earn pricing power.[1]

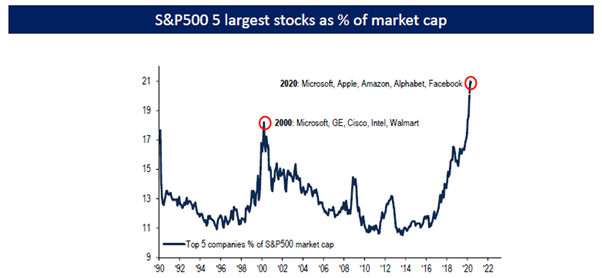

What Thiel said provides a simple framework to understand the value creation models of what were the top five Nasdaq businesses – Microsoft, Apple, Amazon, Alphabet (Google) and Facebook – that have now gone on to dominate the S&P 500. In just three years these five companies have now grown from ~10% of the S&P500 as a percentage of market capitalisation to 20%:

Source: BofA Global Investment strategy, Bloomberg

These five companies operate in different areas, but have all become technology toll-roads in their areas of expertise. Despite their differences, they all have the following attributes:

1. The presence of monopolistic businesses within each that produce high returns on capital

2. The ability to adapt to change – eg. desktop to mobile, on-premise to cloud, license to subscription

3. Low customer acquisition and retention costs

4. High fixed costs, low marginal costs and hard to replicate assets

5. The creation of network effects to entrench customers and users

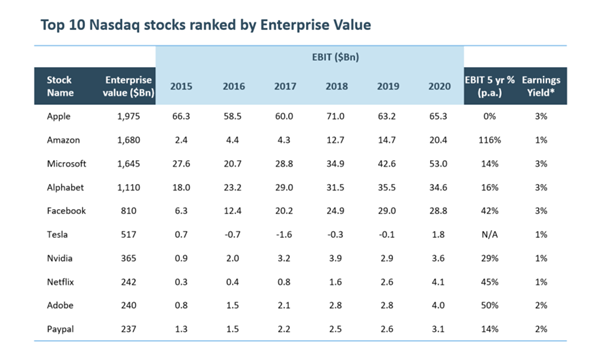

These competitive advantages have resulted in the creation of large competitive moats as evidenced by the below table showing the five-year annualised growth rates of operating income for the majority of the Nasdaq top 10.

Source: FactSet as at November 2020. Note: 2020 EBIT for all businesses ex. Adobe are on Year-end (Apple) or Last 12 months (LTM) (remainder) basis to September 2020. 2020 EBIT for Adobe is LTM to August. *2020 EBIT/Enterprise value.

As businesses strengthen their positions their valuation rises – good businesses deserve to trade at good prices. However, a combination of passive and active forces has resulted in ‘valuation inflation’ that is suggestive of a bond-like return profile for these stocks. Referring to the table, none of the top 10 have an earnings yield of over 3%, with four out of the ten yielding 1%.

While yields are low, risks in these stocks are high, particularly as investors tend to crowd into these stocks when the news is seen as most positive. Current valuations do not capture the emerging signs of slowing growth or excessive optimism, including:

1. Increasing competition with one another in search, content (music/ video), payments and ecommerce

2. Anti-trust laws limiting the ability to acquire start-ups and future competitors

3. Adobe’s market capitalisation ($230 billion) being more than its 2022 total addressable market ($120 billion)

4. Elon Musk’s net worth ($132 billion) being greater than Tesla’s cumulative sales since 2008

5. Apple’s shift to services to offset the cyclicality of iPhone sales

6. Nvidia’s aggressive acquisition of chip designer Arm Holdings from Softbank.

While these businesses have performed very well as a group the sector’s rating is predicated on continued sustainable and strong earnings growth. The future value of these franchises is still heavily tied to terminal value, thus heavily correlated to bonds as an anchor point. We are of the view that there is more downside potential in the bond market than upside.

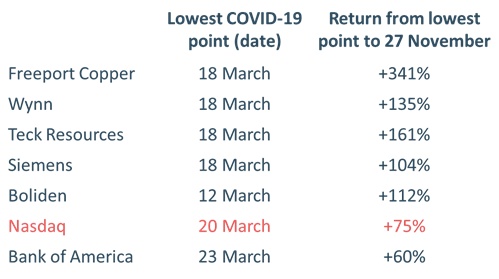

Put these stocks up against cyclical businesses. Since the March 2020 market trough it may have seemed that the tech darlings have been travelling well, but there has already been a rotation away from these momentum stocks, with the formerly heavily out-of-favour cyclical businesses across various industries outperforming:

Source: PM Capital

Despite these gains, and despite the greater competitive nature of their industries when considered on the surface, valuations in these cyclical sectors still remain low in a relative sense and may provide a greater risk-return outcome, rather than overpaying for today’s perceived high quality, high growth businesses. Typically when these shifts occur they occur for the long term – sometimes as long as ten years.

The continuing valuation dispersion between the ‘losers’ - deeply-unloved cyclical stocks - and widely held quality growth stocks has seemingly reinforced Peter Thiel’s comments that competition is for losers and that the ‘winners’ will continue to be so.

However, at present extremes, we would argue deploying capital into high quality, cyclical businesses with attractive valuations may be more sensible than chasing the monopoly-type growth businesses being afforded risky valuations dependant on near zero risk free rates and perpetually strong earnings growth. Competition may be for losers, but, due to their valuations, the high-quality cyclicals may in fact be the future winners for investors.

[1] https://www.alleywatch.com/2015/08/according-peter-thiel-competition-lo….

The content reflects opinions as at the time of writing and may change. PM Capital may now or in the future deal in any security mentioned. It is not investment advice.

Want to be the first to learn about our insights and events? Subscribe below!

More on the Global Companies Fund

More on the ASX-traded Global Opportunities Fund